Form 16 Filling Consultant in Chennai

Form 16 will be your pay TDS certificate. If your salary for the year exceeds the exemption limit of Rs. 2,50,000, your employer is obliged, under Income Tax Act, to take deductions of TDS on your pay and then deposit it with the government. If you've also disclosed the income you earn from other sources at work, they'll look at your income as a total for the TDS deduction. If your income falls less than the basic exemption limits Your employer is not able to deduct any TDS and won't provide this form to you. If you've had multiple employers during the year, you'll have more than one Form 16.

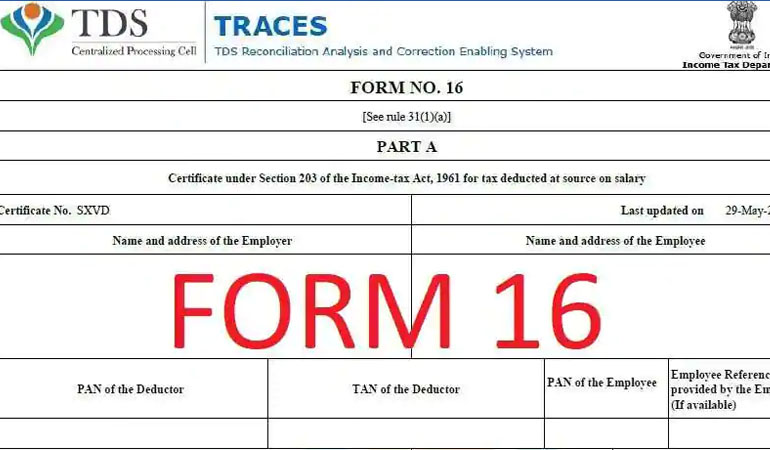

This form 16 is a form of certificate in which the employer certifies the details of the salary you've earned throughout the past year and the amount of TDS was taken out. It has two sections - Part A and Part B.

Part A includes information of the employer and employee such as name, addresses, TAN, and PAN details as well as the duration of employment, and details of TDS which was deducted and then deposited to the government.

Part B contains details about salaries paid, other incomes, deductions allowed, tax payable, etc.

Form 16 can be described as a form that is issued to salaried employees from their employer when they deduct tax from their salary. It is an acknowledgment that states that tax deductions have been paid to the Revenue Tax Department. It is due on or before the 15th June of the year in the tax year it is issued. For instance, for F.Y. 2019-20, the deadline for the submission of Form 16 is 15 June 2020. However, the due date has been extended until 15 August 2020.

Form 16 A Filling Consultancy in Chennai:

Form 16A can also be used as the TDS Certificate. Even though Form 16 is intended for only income from salary. Form 16A can be used to TDS on income other than Salary.For instance, a form 16A is issued to you when banks deduct TDS on the interest you earn from fixed deposits as well as for TDS taken out of insurance commissions or TDS took off the rent you receive. In actuality, it is when TDS is taken out of any other income which is subject to such deduction. The certificate also contains specifics of the address and name of the deductor/deductee, their PAN/TAN information as well as the challan number of TDS deposits. Also, it contains information on earnings you've earned and the TDS taken out, and the amount that you have deposited on that income. The information contained on Form 16A is also available in Form 26AS. It can be employed to fill out your tax return.

But it is not the case on Form 16. The information on Form 16 which is included in Form 26AS is only TDS that is deducted by the employer. Both of these forms are essential and will help to file your return with ease. It is also possible to verify the details of your income and determine the number of TDS that was deducted and at what rate.